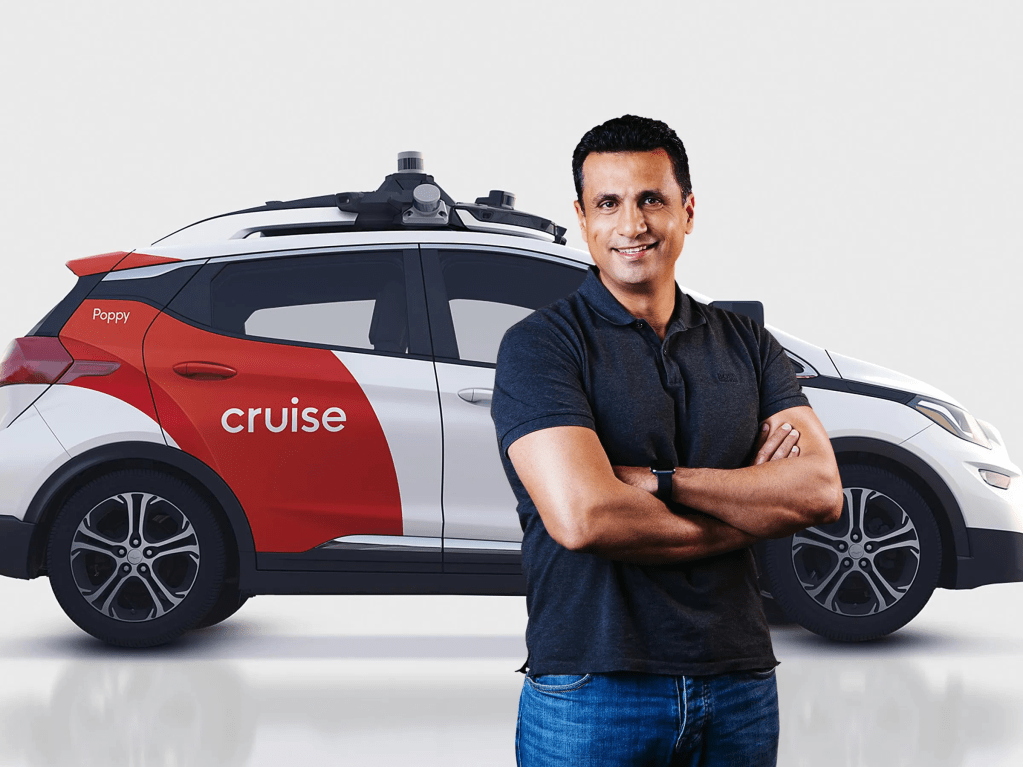

With founder & CEO & CTO Kyle Vogt’s resignation, Cruise’s EVP of engineering, Mohamed Elshenaway is now President, and seemingly running the company.

I never met Mo personally during my time at Cruise, but he was well-regarded and universally known by his nickname.

According to various news outlets, Mo sent a company-wide email on Thanksgiving Wednesday, outlining the next steps for Cruise. These include a continued focus on the Chevy Bolt (the tradeoff being delays in the future Origin platform), a renewal of driverless service in a single city, and a limited number of layoffs.

The speculation is that Cruise will begin driverless testing in a more friendly regulatory environment than San Francisco, probably Texas or Arizona. That makes sense politically, but culturally Cruise is highly tied to San Francisco. The logic was always to focus on the city that is both one of America’s toughest and home to the company’s headquarters and most of its employees. Once Cruise cracked San Francisco, everything else would be easier.

A few things have changed in the last few years that might call that logic into question:

- Cruise employees are much more geographically distributed. The pandemic normalized remote work, and the tech boom made Cruise more flexible in hiring employees (especially engineers) beyond the Bay Area.

- Waymo’s alternative approach of starting in a much easier environment – Phoenix – and then expanding to San Francisco seems to be successful.

- Cruise’s non-fatal but repeated mishaps strained its relationship with California regulators and San Francisco city officials.

Another notable element of the reported email is that, while layoffs are coming, layoffs in engineering roles are previewed as minimal. One possible outcome could be that low performers might be culled, but otherwise the engineering organization would remain intact.

Perhaps the most important signal, at least to shareholders like myself, is that the plan seems to be for Cruise to continue as a robotaxi-focused mobility company distinct from General Motors.

In the aftermath of Kyle Vogt’s resignation, some people speculated that Mo’s elevation to president might foreshadow efforts to deprioritize operations and perhaps even bring the engineering team into General Motors. So far, that looks to be maybe not the case.